Understanding $1000 Personal Loans For Bad Credit: A Comprehensive Inf…

페이지 정보

본문

In in the present day's financial panorama, securing a personal loan will be a vital lifeline for people facing unexpected bills or those looking to consolidate debt. Nevertheless, for people with dangerous credit score, the options can appear limited and daunting. Fortunately, there have been demonstrable advances in the availability and accessibility of $a thousand personal loans for these with less-than-good credit ratings. This article delves into the current panorama of personal loans for bad credit, highlighting key features, potential lenders, and methods for securing a loan regardless of credit score challenges.

The Challenge of Dangerous Credit score

Unhealthy credit is often outlined as a credit score under 580, which might end result from numerous factors, together with missed funds, excessive credit score utilization, or even bankruptcy. Individuals with bad credit score usually face greater interest charges, stricter phrases, and will wrestle to qualify for conventional loans. Nonetheless, the rise of alternative lending options has opened doorways for a lot of who previously felt excluded from the monetary system.

Advances in Lending Know-how

One of many most important advances in the personal loan sector is the emergence of on-line lenders and fintech firms that make the most of advanced algorithms to evaluate creditworthiness. Unlike traditional banks that rely closely on credit scores, many online lenders consider extra elements, reminiscent of income, employment history, and even banking patterns. This holistic approach permits them to offer loans to individuals with dangerous credit score, making $one thousand personal loans more accessible.

Peer-to-Peer Lending

One other innovative resolution is peer-to-peer (P2P) lending platforms. These platforms join borrowers instantly with individual traders keen to fund their loans. P2P loans usually include extra versatile phrases and lower curiosity rates than traditional lenders. Web sites like LendingClub and Prosper permit borrowers to present their tales and monetary needs, enabling investors to make knowledgeable choices based on extra than simply credit scores.

Credit score Unions and Community Banks

Credit unions and group banks have also made strides in offering personal loans to those with bad credit. These institutions typically have a extra personalised strategy to lending and could also be extra keen to work with borrowers to search out an answer that matches their needs. Many credit unions offer small personal loans, generally as little as $1000, with cheap terms and lower curiosity charges in comparison with payday lenders.

The Position of Secured Loans

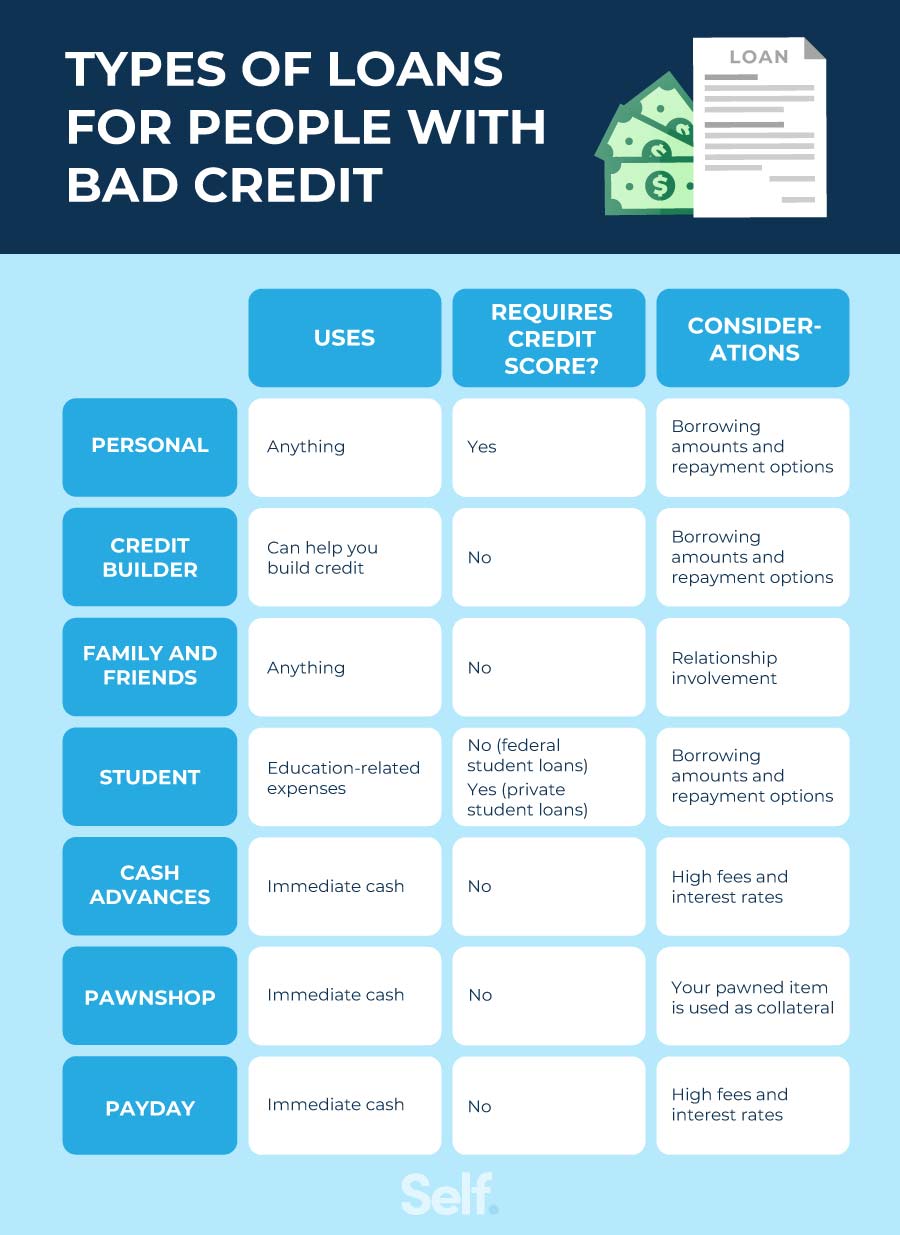

For individuals with bad credit, secured personal loans generally is a viable option. These loans require collateral, equivalent to a vehicle or personal loans for bad credit financial savings account, which reduces the lender's danger. Consequently, borrowers might qualify for higher rates and phrases. The $1000 personal loan might be secured against an asset, making it easier for those with unhealthy credit score to acquire the funds they want.

On-line Comparability Instruments

The advent of on-line comparability instruments has revolutionized the way in which borrowers find personal loans. Web sites like Credible and NerdWallet permit customers to compare multiple lenders and their offerings in a single place. This transparency permits borrowers to establish the perfect rates and terms available for $one thousand personal loans, even with bad credit score. By utilizing these instruments, borrowers can make informed decisions and avoid predatory lending practices.

Understanding Loan Terms

When in search of a $1000 personal loan, it's essential for borrowers to grasp the terms of the loan, especially if they've dangerous credit score. Interest charges can range considerably based on creditworthiness, and borrowers must be cautious of loans with excessively high charges that may lead to a cycle of debt. Moreover, understanding the repayment terms, including the size of the loan and any associated charges, is important to make sure that the loan is manageable.

Constructing Credit with Personal Loans

Apparently, taking out a personal loan may also serve as a method for rebuilding credit. By making well timed payments on a $one thousand personal loan, borrowers can positively impact their credit score scores over time. This enchancment can lead to raised loan choices sooner or later, making a pathway to monetary restoration and stability.

Finding the appropriate Lender

When looking for a $1000 personal loan with unhealthy credit score, it is important to do thorough analysis on potential lenders. Look for lenders that specialize in bad credit loans and browse critiques from previous borrowers. Be certain that the lender is respected and clear about their phrases. Additionally, consider reaching out to local credit unions or neighborhood banks, as they might provide personalized options that larger establishments do not.

The Significance of Monetary Training

As borrowers navigate the world of personal loans, monetary schooling becomes paramount. Understanding credit scores, curiosity charges, and loan phrases can empower individuals to make higher financial choices. Many organizations provide free resources and workshops to assist people enhance their monetary literacy, which may ultimately lead to higher loan choices sooner or later.

Conclusion

Securing a $a thousand personal loan with dangerous credit is extra attainable than ever, due to advances in know-how, the rise of alternative lending options, and a rising awareness of the importance of financial literacy. By leveraging on-line instruments, exploring peer-to-peer lending, and contemplating secured loans, individuals with unhealthy credit can find viable options to their financial wants. As the lending landscape continues to evolve, borrowers are inspired to stay informed and proactive of their pursuit of monetary stability.

- 이전글BK8 – Thiên Đường Cá Cược Trực Tuyến 25.08.25

- 다음글The Next Big Event In The Local Bifold Door Installers Industry 25.08.25

댓글목록

등록된 댓글이 없습니다.