Are Unsecured Loans Bad for Your Credit?

페이지 정보

본문

Introduction

Unsecured loans have change into increasingly standard amongst customers searching for financial flexibility with out the need for collateral. Nevertheless, many borrowers are concerned about how these loans might impression their credit score scores. This examine report aims to explore the connection between unsecured loans and credit score scores, inspecting both the potential dangers and benefits related to these types of loans.

Understanding Unsecured Loans

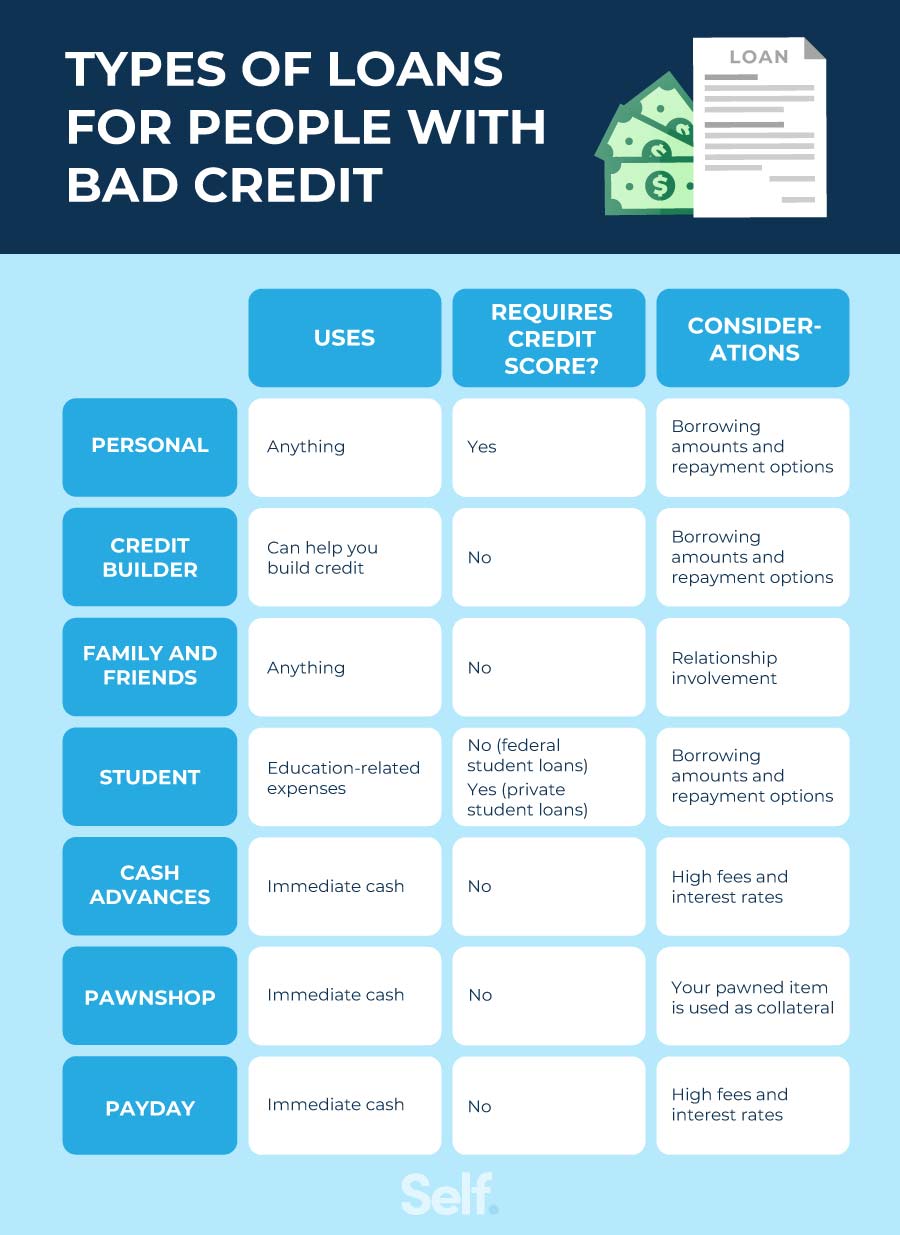

Unsecured loans are monetary products that do not require collateral, reminiscent of a home or vehicle, to safe the loan. Instead, lenders evaluate a borrower's creditworthiness based on their credit historical past, revenue, and other monetary indicators. Common sorts of unsecured loans embody personal loans, credit score cards, and hard money personal loans bad credit student loans. As a result of they carry more risk for lenders, unsecured loans often include greater interest charges compared to secured loans.

The Affect of Unsecured Loans on Credit score Scores

Credit score scores are numerical representations of a borrower's creditworthiness, and so they play a critical role in figuring out eligibility for loans, curiosity charges, and other financial merchandise. If you have any inquiries relating to where by and how to use hard money personal loans bad credit, you can contact us at our own web page. Understanding how unsecured loans have an effect on credit scores involves analyzing several key elements:

1. Credit Utilization Ratio

One of the most vital components influencing credit score scores is the credit score utilization ratio, which is the amount of credit being used in comparison with the whole accessible credit. Unsecured loans, significantly credit cards, can impression this ratio. If a borrower maxes out their bank card limits, it could result in a better utilization ratio, negatively affecting their credit score score. Ideally, borrowers should purpose to maintain their credit utilization under 30% to maintain a wholesome credit score rating.

2. Cost History

Fee history accounts for hard money personal loans bad credit roughly 35% of a credit score rating. Well timed payments on unsecured loans can positively influence a borrower's credit score rating, while missed or late payments may end up in significant score drops. Borrowers must ensure they make payments on time to keep away from damaging their credit scores. Setting up automatic payments or reminders can help handle this facet successfully.

3. New Credit Inquiries

When making use of for an unsecured loan, lenders typically perform a tough inquiry on the borrower's credit score report, which may quickly lower the credit score rating. A number of inquiries inside a brief interval can exacerbate this impact. Nonetheless, it is crucial to note that credit scoring fashions usually account for charge buying, notably for mortgages and auto loans, permitting borrowers to buy for the best rates without severely impacting their scores.

4. Length of Credit score Historical past

The length of credit score historical past is one other factor that contributes to credit score scores. Taking out an unsecured loan can impact this side, especially if it results in the closing of older accounts. Sustaining older credit accounts, even when they aren't actively used, can help enhance the typical age of credit score historical past, positively influencing the credit score rating.

Potential Risks of Unsecured Loans

Despite the advantages, there are potential dangers related to unsecured loans that borrowers ought to consider:

1. Higher Curiosity Charges

Unsecured loans usually include larger curiosity charges in comparison with secured loans. If a borrower struggles to make funds, the accumulating curiosity can lead to a cycle of debt which will negatively impact their credit score rating. It's crucial for borrowers to assess their means to repay the loan before committing to keep away from financial strain.

2. Debt Accumulation

Borrowers may be tempted to take on a number of unsecured loans, resulting in elevated debt ranges. Excessive debt levels may end up in the next credit score utilization ratio and should signal to lenders that the borrower is over-leveraged. This may result in lower credit scores and difficulty obtaining future credit score.

3. Danger of Default

If a borrower defaults on an unsecured loan, the lender can not declare any collateral, however they will still report the default to credit bureaus. This can lead to a major drop in credit score rating and can stay on the credit score report for up to seven years, making it challenging for the borrower to secure future financing.

Potential Advantages of Unsecured Loans

Whereas there are risks, unsecured loans may also provide several benefits that may positively impression a borrower's credit score rating:

1. Building Credit History

For people with restricted credit score history, taking out an unsecured loan and making well timed funds can assist build a positive credit profile. This is particularly beneficial for younger adults or those new to credit, as it establishes a track file of accountable borrowing.

2. Debt Consolidation

Unsecured loans can be utilized for debt consolidation, permitting borrowers to mix a number of excessive-interest debts into a single loan with a lower curiosity fee. This could simplify payments and probably enhance the credit score utilization ratio if the borrower pays down present bank card balances.

3. Flexibility in Use

Unsecured loans present flexibility in how the funds can be utilized, whether or not for residence enhancements, medical bills, or other private wants. This may also help borrowers manage their funds extra successfully and avoid monetary stress, contributing to well timed funds and a constructive credit score historical past.

Conclusion

In conclusion, unsecured loans can have each constructive and adverse impacts on a borrower's credit score rating. The key to managing these loans successfully lies in understanding the elements that affect credit score scores and making knowledgeable selections. Borrowers ought to be cautious about taking on too much debt, guarantee well timed funds, and monitor their credit score utilization ratios. By doing so, they'll leverage unsecured loans to build a optimistic credit score historical past while minimizing the dangers related to these monetary merchandise. Finally, the responsible use of unsecured loans can pave the way for improved creditworthiness and higher monetary opportunities sooner or later.

- 이전글The Comprehensive Information to Gold IRA Reviews: Understanding the Benefits And Risks 25.08.22

- 다음글Your Comprehensive Supply Facility Resource: Why Plumbing Supply And More Excels the Heating Industry – Specialist Advice from Rick Callahan 25.08.22

댓글목록

등록된 댓글이 없습니다.