Phone payment conversion is becoming increasingly popular as businesses recognize the convenience it offers to their customers. However, for those new to this technology, the process can seem daunting. This handbook aims to guide beginners through the essential stages and considerations for implementing phone payment conversion in their businesses.

What is Phone Payment Conversion?

Phone payment conversion involves the process of allowing customers to make payments via their mobile devices. This can be done through various methods, including contactless payments, mobile wallets, and QR codes. By simplifying the payment process, businesses can boost customer satisfaction and drive more revenue.

Why Implement Phone Payment Conversion?

Implementing phone payment conversion comes with several benefits. First, it improves customer convenience by allowing them to make payments quickly and securely. Second, it can reduce queues at the checkout, leading to a more efficient operation. Additionally, it opens up new opportunities for marketing, as businesses can gather valuable customer information and provide personalized offers.

Key Steps for Phone Payment Conversion

- Evaluate Your Needs

Before diving into phone payment conversion, it's crucial to assess your business needs. Determine which payment methods your customers prefer and what technologies you will need. For instance, for tech-savvy customers, mobile wallets might be the best option. Conversely, for elder customers, QR codes could be more user-friendly.

- Choose a Trustworthy Payment Gateway

Selecting a reliable payment gateway is essential. A good payment gateway should support multiple payment methods, offer robust security features, and integrate seamlessly with your existing systems. Popular options include PayPal, Stripe, and Square, but there are many others depending on your location and specific requirements.

- Ensure Security and Compliance

Security is paramount when it comes to phone payments. Make sure your payment gateway complies with Payment Card Industry Data Security Standards (PCI DSS). Additionally, consider employing cryptography and tokenization to protect sensitive customer information. Educate your staff on best security practices to minimize risks.

- Integrate Your Payment System

Once you have chosen a payment gateway, the next step is to integrate it into your existing systems. This may involve working with developers to ensure a smooth transition. For e-commerce platforms, plugins and APIs are often available to simplify the integration process. For brick-and-mortar stores, you might need to upgrade your POS system.

- Educate Your Customers

Customer education is key. Ensure your customers understand how to use the new payment methods. Provide clear instructions and perhaps even create tutorial videos. Display QR codes prominently and offer support for customers who encounter issues.

- Monitor and Optimize

After implementation, continuously monitor the performance of your phone payment conversion system. Keep an eye on transaction volumes, success rates, and customer opinions. Use this data to optimize your system and address any issues quickly.

Common Challenges and Solutions

- Technical Issues

Technical issues can arise, but they can be alleviated by choosing a reliable payment gateway and performing regular maintenance. Ensure your systems are up-to-date and have a backup plan in case of downtime.

- Customer Resistance

Some customers may be hesitant to adopt new payment methods. Address this by highlighting the benefits, such as convenience and security. Offer incentives for using phone payments, like discounts or loyalty points.

- Security Concerns

Customers and businesses alike may have security concerns. Address these by implementing strong security measures and communicating your commitment to data protection. Regularly update your customers on the steps you are taking to ensure their transactions are secure.

In Conclusion

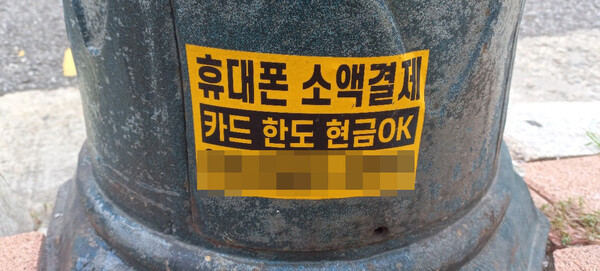

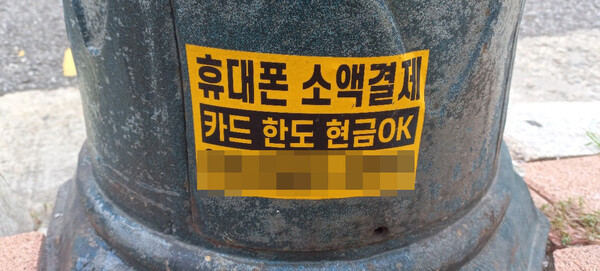

Implementing phone payment conversion can significantly improve your business operations and customer satisfaction. By following the steps outlined in this handbook and addressing common challenges, 소액결제현금화 you can successfully integrate phone payments into your business model. Remember, continuous improvement and customer education are key to a successful transition. Embrace this technology to stay competitive and meet the evolving needs of your customers.